What is Annual Family Giving?

Annual Family Giving is Hope’s yearly appeal to the families of our students to make a financial gift of any amount and to support our yearly fundraising events. In year’s past, we would name a suggested dollar amount per student based on the budget gap between our income and our expenses and divide that between the number of students enrolled.

However, as our income and expenses can change dramatically year to year, as well as student enrollment, we have simplified our suggested donation to $2,500 per family (not per student). Even so, we remind you that any amount will help every student. HCCS has set a goal of 100% family participation to help close our budget gap, and we provide several different volunteer and fundraising opportunities from which families can choose.

DID YOU KNOW?

Annual Family Giving donations account for over 50% of our fundraising each year!

Family participation guarantees Hope students receive the best educational experience possible. This Annual Family Giving Survey is crucial in helping us forecast our fundraising for the year. Please complete this inquiry by September 30th. This information is kept confidential and will help the Development Director and Admin Team improve our fundraising process.

Tips For Meaningful Giving

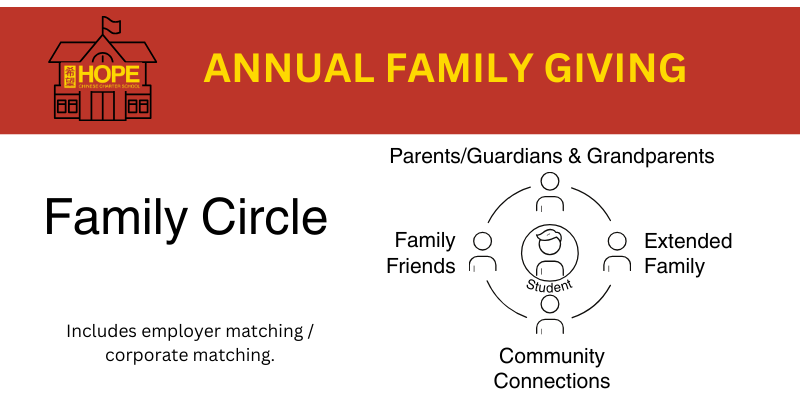

Invite Your “Family Circle”

Annual Family Giving includes donations from family friends, extended family and community connection. Hope families can invite their family circle to participate in school fundraisers like Giving Tuesday, the Red Envelope appeal, Jog-A-Thon and more.

Make a Recurring Gift

If it is easier financially, you can set up a recurring monthly gift through our Annual Family Giving donation page. Please be sure to create an account with Kindful, our donation platform, so you can login and manage your gift any time.

HCCS is a 501(c)(3) nonprofit, so contributions are tax deductible (in accordance with tax laws).

Make Use of Matched Giving

If your employer will match your donation or the value of your volunteer hours, that will count toward your Annual Family Giving as well. This is a great way to double your efforts and bring more money into the school for all of our kids.

DID YOU KNOW?

Hope received over $120K in corporate donations alone last year.

Ask Your Employer to Match

If your employer does not match donations yet, ask if they will consider it. Companies of all sizes match donations their employees make to nonprofits because it’s an easy, structured way for them to support good work in their communities. Corporate matching gifts are an efficient and straightforward way for companies to build relationships with charities.

Intel & Nike Employees

If you work for Intel or Nike, you have the option to donate through their donation website (i.e. Benevity, YourCause). This is the easiest way to ensure the company’s matching donation gets made. You can pay with a credit or debit card and the company will send both the donation and matching donation to Hope.

If you need to pay with check, cash or ACH through the school, you will need a Donation Receipt (automatically sent by email from the development office after the donation has been recorded). After you receive your donation receipt, submit that to the Intel/Nike website to get the company to send a matching donation to Hope.

Intel Matching Instructions

Make sure you are logged in to the Intel Intranet

Browse to http://communitygiving.intel.com/ or https://intel.benevity.org/

Nike Matching Instructions

Contact your company representative for assistance https://nike.benevity.org/user/login.

Other Ways to Give

Donor Advised Funds (DAF)

A donor advised fund, or DAF, is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. You can contribute cash and non-cash assets like securities, stocks and more to a DAF managed by a sponsoring 501(c)(3) organization, and take an immediate tax deduction. Then, the sponsoring organization can invest your funds for tax-free growth until you are ready to recommend your that your sponsoring organization uses some or all of your funds to make a grant to Hope.

IRA Qualified Charitable Distributions (QCD)

Also known as IRA Charitable Rollovers, if you are over 70 and have a traditional IRA, you may be eligible to make a Qualified Charitable Distribution to Hope. You can use the QCD to meet your annual Required Minimum Distribution and reduce your taxable income! Contact your IRA administrator to see if you are eligible and request a QCD from your IRA to Hope Chinese Charter School!

Thank you to all who continually provide

financial support to HCCS

financial support to HCCS